Abstract:

LVMH's affiliated PE platform L Catteron announced the SPAC acquisition of Lotus Tech by L Catteron Asia Acquisition Corp. (LCAA). As a luxury EV manufacturer with solid global distribution and getting strong support from Geely, its parent company, Lotus is entering the capital market at a high valuation. We did a comprehensive analysis of the perspective of Lotus and conducted the valuation practices for both Lotus Tech and LCAA. Our De-SPAC model shows a big concern about the deal rooted in the aggressive revenue growth forecast by L Catterton, which may be related their belief in the platform of Geely.

Content:

- 2.1 Sales Volume Forecast for Luxury Electric Vehicle Market

- 2.2 Competitiveness analysis

- 3.1 Selecting the Multiple

- 3.2 Comparables and Target Range

- 4.1 Cash and Valuation Metrics

- 4.2 Ownership

- 4.3 LCAA's Profit

- 6.1 Exchange Rate Risk

- 6.2 China Luxury Electric Vehicle Market Size is overestimated

- 6.3 Market Share of Lotus is overestimated

- 6.4 Logistical Risk

- 6.5 Fund Acquisition Risk

1. Introduction

On Jan 31, 2023, L Catterton Asia Acquisition Corp (LCAA) announced its acquisition of Lotus, a subsidiary of Chinese automaker Geely, focusing on the high-end EV market. As a SPAC backed by L Catterton, a consumer-focused PE enjoying a special relationship with LVMH, it is a special deal for them to bet on the EV industry.

Figure 1: L Catterton Asian Portfolio

Source: L Catterton Website

Source: L Catterton Website

Geely takeover the Lotus from Malaysia's Proton in 2017. After that, Geely invested 3 billion pounds in revamping the British brand by opening factories and launching new models. The most recently constructed factory in Wuhan, which can produce 150,000 vehicles a year, will facilitate the manufacture of Lotus' first models. Wuhan's government fund also holds convertible bonds, the Lotus, to promote coordination.

Lotus Tech has wanted to go public since 2021, aiming to replicate the massive success seen by luxury auto brand listings such as Porsche AG, which pulled off Europe's largest IPO in a decade. This deal is also significant in the history of SPAC as the biggest SPAC deal in almost a year.

Figure 2: Recent SPAC Deals by Month

Source: SPAC Researc

Source: SPAC Researc

Lotus announced that the funds acquired from the SPAC listing would be used towards delivering its first model, the electric SUV Eletre. Lotus aims to sell the vehicle in China in the first quarter before expanding to the European Union and Britain. Electre features a bevy of innovations, featuring fully embedded L4 hardware capabilities made possible by the first deployable LiDAR system in the world and a custom software system created by Lotus. The model also feats high energy efficiency, fast data transfer, and supercharging capabilities 800V high-voltage battery. Instead of competing with large EV makers like Tesla, Geely has been steering it away from combustion engines and has several all-electric models planned for the coming years. Lotus wishes to solidify its standing in the luxury EV industry instead, competing with companies like Ferrari and Aston Martin and delivering all-electric, sustainable luxury vehicles worldwide. According to Qingfeng Feng, chief executive of both Lotus Group and Lotus, the merger will position Lotus. as a “leading global luxury EV company” and that the deal brings “promising brand collaboration and strategic partnership potential worldwide.” In its IPO in 2021, LCAA stated that they “intend to focus on our search in high-growth consumer technology sectors across Asia.” In the investor presentation, LCAA projected Lotus's CAGR in 2023E-2025E to be high as 90%. According to Chinta Bhagat, Co-Chief Executive Officer of LCAA, “Lotus Tech is well positioned to benefit from these dynamics, as it is a pioneer in decarbonizing luxury automobiles,” expressing his confidence in Lotus becoming a significant player in the luxury EV industry.

2. Revenue Forecast

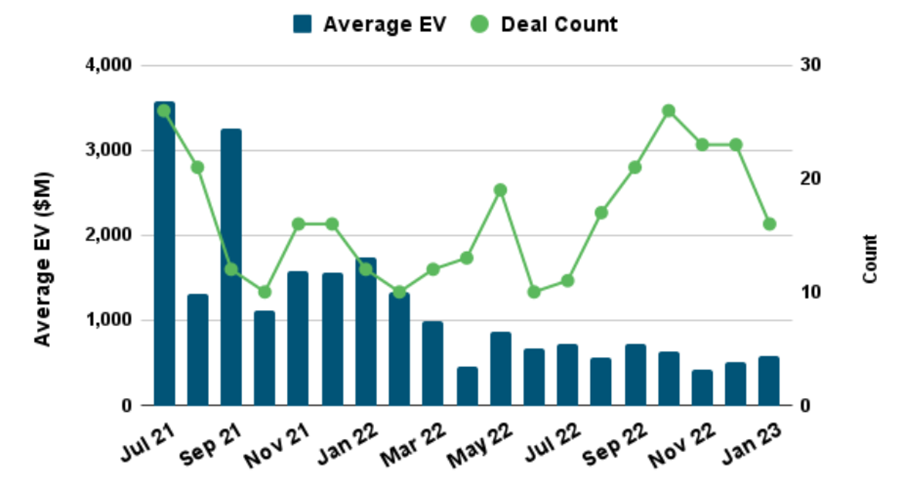

2.1 Sales Volume Forecast for Luxury Electric Vehicle Market

The luxury electric vehicle is defined as electric vehicle whose price is over 80,000 USD and less than 149,000 USD which is Lotus's target price range. According to Lotus's plan, around 50% of its sale will be in China and the rest of its sales will be in Europe, the United Kingdom, and the US. This section provides forecast for sales volume and market size of luxury electric vehicles in the given price range by region with some supporting key assumptions. Subsections below will introduce the expected growth rate and changes in market share first, and the detailed forecast data will be shown in the end. The forecast takes forecast from Lotus Investor Presentation, Carolina Journal, Insideevs, CleanTechnica as references. The forecast also uses data from Autohome Inc. and Yahoo! Autos.

2.1.1 Global Sales Volume Forecast

In the global electric vehicle market, the sales volume is expected to grow at a compounded annual growth rate of 30.7% from 2023 to 2025. For the luxury section in the electric vehicle market, the sales volume is expected to grow at a compounded annual growth rate of 38%, according to Lotus Technology's expectations. It will result in a fluctuating market share between 1.8% and 1.92% in the electric vehicle market.

2.1.2 China Sales Volume Forecast

In China's electric vehicle market, the sales volume is expected to grow at a compounded annual growth rate of 35.1% with a compounded annual growth rate of 46% in the luxury sector. The market share of luxury electric vehicles in China's electric vehicle market is expected to grow from 0.48% to 0.67% at the same time.

2.1.3 US Sales Volume Forecast

In US electric vehicle market, the sales volume is expected to grow at a compounded annual growth rate of 29% with a compounded annual growth rate of 38% in the luxury sector. The market share of luxury electric vehicles in the US electric vehicle market is expected to grow from 10.42% to 11.92% at the same time.

2.1.4 EU Sales Volume Forecast

In the EU electric vehicle market, the luxury electric vehicle market is expected to grow at a compounded annual growth rate of 36%. The market share of luxury electric vehicles in the EU electric vehicle market is expected to drop from 2.4% to 2.1% simultaneously.

2.1.5 UK Sales Volume Forecast

In UK electric vehicle market, the sales volume is expected to grow at a compounded annual growth rate of 42% with a compounded annual growth rate of 35% in luxury sector. The market share of luxury electric vehicles in the UK electric vehicle market is expected to drop from 0.64% to 0.58% at the same time.

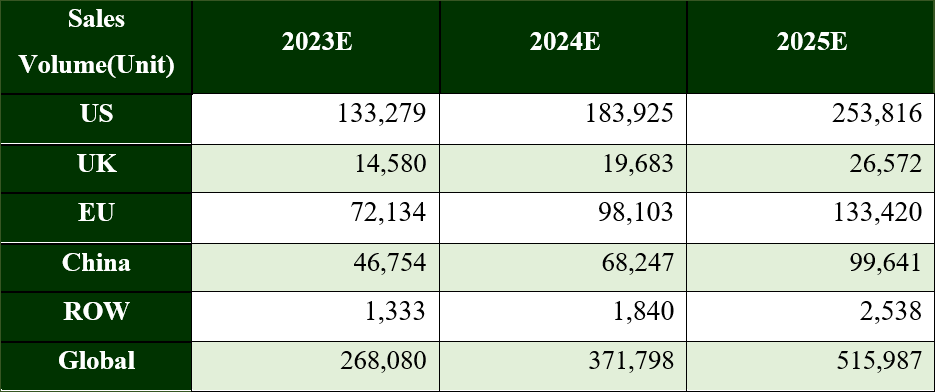

Figure 3: 2023-2025 Sales Volume of Luxury Electric Vehicle

Source: Lotus Investor Presentation, Carolina Journal, insideevs, CleanTechnica

Source: Lotus Investor Presentation, Carolina Journal, insideevs, CleanTechnica

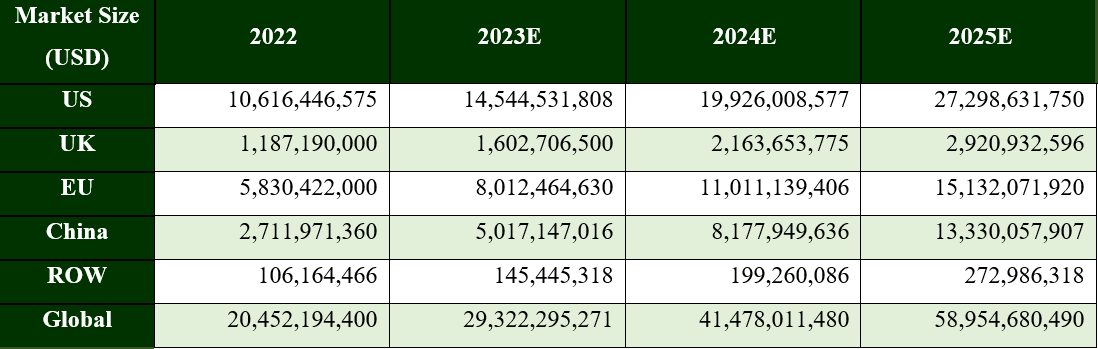

2.1.6 China Market Size Forecast

In China's luxury electric vehicle market, the luxury electric vehicle models mainly concentrate around 576,000RMB with a weighted average price of 585,000RMB. The market size is expected to grow at a high rate in 2023 as many new luxury electric models are introduced to China, which will generate rapid growth in the average price of luxury electric vehicles and sales volume. After 2023, the market size is expected to grow at a compounded annual growth rate of 63% in 2024 and 2025 respectively.

2.1.7 Global Market Size Forecast

The price levels used for markets besides China market are different, as existing luxury vehicle models in regions other than China have a higher price range. Though the price levels and growth rates may differ across the regions except for China, here assumes that the price levels and growth rates are like those in the US with some adjustments and the difference is minor which will not affect the forecast result. Here also assumes that the luxury vehicle average prices will not fluctuate severely in the forecast period and will not affect the forecast result. In US luxury electric market, the luxury electric vehicle models mainly concentrate around 119,000 USD with a weighted average price of 120,904 USD. The market size is expected to have a compounded annual growth rate of around 38%.

Figure 4: 2022-2025 Market Size of Luxury Electric Vehicles in Different Regions

Source: Lotus Investor Presentation, Carolina Journal, insideevs, CleanTechnica, Autohome Inc.

Source: Lotus Investor Presentation, Carolina Journal, insideevs, CleanTechnica, Autohome Inc.

Figure 5: 2022-2025 Market Size of Luxury Electric Vehicles by Region

Source: Lotus Investor Presentation, Carolina Journal, insideevs, CleanTechnica, Autohome Inc.

Source: Lotus Investor Presentation, Carolina Journal, insideevs, CleanTechnica, Autohome Inc.

2.1.6 Key Assumptions of Growth rate by region

With COP26's ambition of making a 100% share of ZEVs in new car and van sales by 2040 globally and by 2035 in “leading markets,” the global electric vehicle sales growth rate in 2022 is around 57%. But with the increasing coverage of the main audience of new energy vehicles, the growth rate of sales volume will be at a moderate level around 30.7% according to businessweekly research. In China, as the fuel economy standard tightened with the expected issuance of new luxury models by BYD, NIO and etc., and meanwhile, the China luxury vehicle customer groups are still in the process of accepting electric vehicles, which is a potential driver of the rapid growth of luxury electric sales volume in the future. The luxury electric vehicle sales volume growth rate is expected to be higher than that of the whole electric vehicle market as predicted by EqualOcean Intelligence. US faces a similar situation with a bigger market share of luxury electric vehicles as there are much more existing luxury electric vehicle in the US. For EU and UK, the growth rate is rather slow as the electric vehicle ownership is higher. As predicted by Lotus Technology and other institutions, the luxury electric sales volume will grow slower than the whole electric vehicle market in EU and UK at certain rates mentioned above.

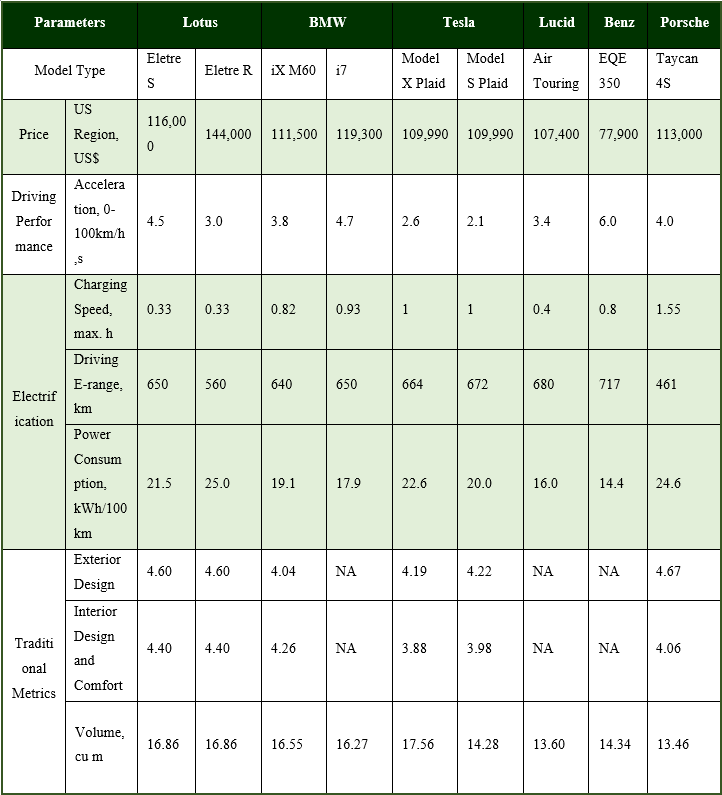

2.2 Competitiveness analysis

As a new entrance to the EV market, whether Lotus's accumulation of technology could support it transform from conventional fuel vehicle brand to new energy vehicle brand is still suspectable.

So here we choose models mentioned in Lotus's pitch deck together with the top 10 best luxury electric models selected by Forbes Wheels 2023 as the competitors for Lotus to analyse the position of Lotus in luxury electric vehicles market.

2.2.1 Technological analysis

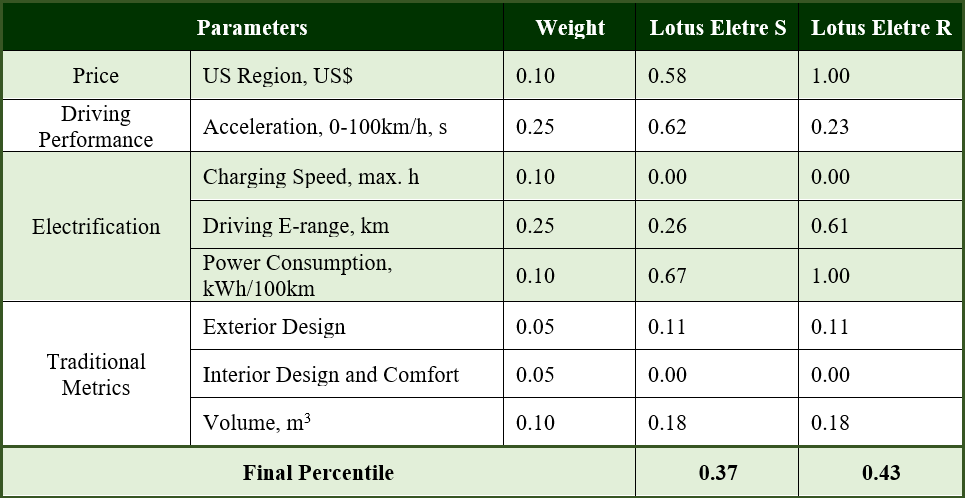

To compare Lotus Eletre with models from other brands, we select eight core indicators to represent the performance of the models. Normally we assume that the higher the price is, the better the performance of a car should be, so price indicator works as a penalty term. 0-100 km/h acceleration time is the most widely used indicator for the power capability.

For the Electrification Performance, Charging Speed and Driving E-range are the indicators that directly affect consumers' daily driving experience. And power consumption reflects whether a car is economical after purchase.

For the Traditional Metrics, Exterior Design, Interior Design and Comfort scores are sourced from Dongchedi as a reference. The socres are calculated based on the reviews from car owners on Dongchedi. Though not authoritative, the socres still can partily reflect market recognition. The volume indicator is related to the available space of the car which reflect the comfortable capability when using the car.

Figure 6: The comparison of performance indicators among different luxury electric vehicles

Source: Electric Vehicle Database, Dongchedi

Source: Electric Vehicle Database, Dongchedi

To quantify the performance of Lotus on different indicators, we use the overall scope of selected nine models as the total distribution and calculate each indicator's percentile based on the distribution. The lower the percentile and ranking is, the better the performance is.

Figure 7:The percentile of Lotus among different luxury electric vehicles

Source: Filings

Source: Filings

Then we give different weight to each indicator based on its different impact on the overall performance and competitiveness of the car. For example, though Volume and Exterior and Interior Design influence consumers' decisions when buy cars, those Electrification indicators are more important than them. So we give Traditional Metrics lower weights compared to Electrification.

Figure 8:The weighted average percentile of Lotus among different luxury electric vehicles

Source: Filings

Source: Filings

The Final Percentiles for Lotus Eletre S and Lotus Eletre R are 0.37 and 0.43, which mean that the models of Lotus are competitive compared to those existing and excellent competitors in luxury electric vehicles market.

2.2.2 Sales analysis

The number of direct sales stores and dealerships will affect the convenience of consumers to access and buy cars, which is positively related to the sales volume of the brand. Besides, the distribution of stores and dealerships also reflects corporate's different priority on each country/region. It is reasonable that the brand should perform better in country/region of higher priority as it devotes more resource and efforts to that country/region.

Figure 9: The number of direct sales stores and dealerships of different brand

Source: Tesla, ScrapeHero, Datanify, Automotive News Europe

Source: Tesla, ScrapeHero, Datanify, Automotive News Europe

Because Lotus is a UK-based sports car brand, the number of Lotus's existing stores in China is not significant. Lotus plans to rapidly expand its business and expects to have 130 stores in China by 2025. Compared to those historic brands like BMW and Benz, the number of Lotus's stores is still lagged far behind even after the expansion. But the gap may mainly because the models of BMW and Benz cover both luxury vehicles and regular vehicles. When compared to Tesla and Porsche, the progress of Lotus's expansion is still considerable.

2.3 Revenue Forecast

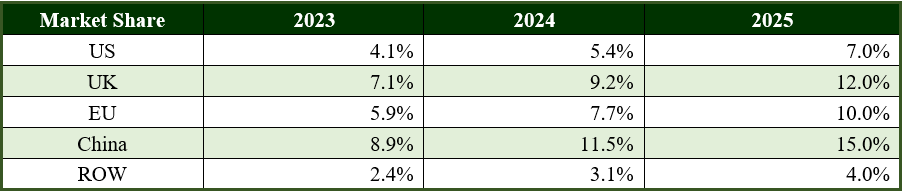

Since Lotus devotes different efforts to different countries/regions, we need to give different market share assumptions for each country/region.

Based on the number of Lotus's direct sales stores and dealerships in different regions and Lotus's technology advantages compared to other brands, we give the assumption of Lotus's market shares in different regions as follow.

Figure 10: Assumption of Lotus's market shares in different regions

Source: Filings

Source: Filings

3. Valuation

3.1 Selecting the Multiple

In the EV industry, the market approach of valuation usually chooses revenue multiple as most companies are not yet profiting due to the universal low margin in the industry. The acquisition of Lotus also applies revenue multiple as the valuation methodology and 0.9x 2024E revenue or 0.6x 2025E revenue to the deal, implying an EV of US$ 5,447 million.

3.2 Comparables and Target Range

We put the comparable companies into two groups to weigh their comparability. As a pure-play EV company, Lotus is more comparable to listed EV manufacturers.

Figure 11: Comparable Companies

Source: Wind

Source: Wind

We believe Chinese mixed auto manufacturers, e.g., Lotus parent company Geely, can help determine the proper valuation of Lotus with a lower weight.

Figure 12: Weight of Groups of Comparables

Source: IBSG Research

Source: IBSG Research

The comparable company indicates a 3x 2022 revenue multiple based on the weight assigned above. This is equivalent to a forward multiple of 0.83x1 2024E revenue and 0.61x2 2025E revenue, which is close to the acquisition's valuation multiple of 0.9x 2024E revenue or 0.6x 2025E revenue.

Therefore, we believe 0.6x 2025E revenue multiple is most proper for valuating the company.

4. De-Spac

4.1 Cash and Valuation Metrics

The 2021 IPO of LCAA exercised full greenshoes. Assuming no redemption by LCAA's shareholders, the trust has $288 million cash. Jingkai Fund, a government fund of Wuhan city, China, is expected to exercise equity conversion of its convertible bond, providing an additional source of cash. Lotus also hopes to raise $100 million of 3rd party investment before the closing. Before the PIPE, the cash balance of the merged entity is calculated as follows.

Figure 13: Cash Source

Source: LCAA Investor Presentation

Source: LCAA Investor Presentation

Based on the cash and debt level, we can get the following valuation metrics with the projected revenue in the second part of the report. The base case is 0.6x revenue in 2025, corresponding to an EV of 3471 and the LCAA pre-deal share price of 6.49.

Figure 14: Valuation Metrics

Source: IBSG Research

Source: IBSG Research

4.2 Ownership

The original shareholders of Lotus, including Geely, still hold the majority stake in the merged entity. The post-De-Spac ownership considers the minimum conversion of Jingkai Fund's convertible bonds. Like most of the SPAC deals, the original shareholders of Lotus roll over all its equity interest.

Figure 15: Ownership after De-Spac

Source: LCAA Investor Presentation, IBSG Research

Source: LCAA Investor Presentation, IBSG Research

The potential PIPE may further dilute the equity while expanding Lotus's billion-level cash balance for expansion.

4.3 LCAA's Profit

It is widely discussed how much the Sponsor of SPAC deals profits from the Sponsor promote. To date, L Catterton holds 30% Sponsor Shares in SPAC, which is higher than the usual practice of 25%. The Sponsor Shares are subjected to earn-out and forfeiture arrangements tied to Sponsor's affiliates' participation in the following PIPE financing and strategic partnership with Lotus Tech, and 5% of Sponsor Shares may be transferred to certain LCAA public shareholders to induce such public shareholders not to exercise their redemption rights. Based on the merger valuation, the 30% Sponsor Shares have a net worth of $78 million based on the valuation on the merger.

5. Conclusion

The stock price in the base case (0.6x revenue) of the company value is far below $10, so we cannot justify the acquisition valuation of Lotus.

Our valuation ratio is consistent with the acquisition. Still, the implied revenue CAGR is lower than the acquisition valuation growth rate of 90%.

To calculate the expected revenue of Lotus in 2025, we predict the market size of luxury electric vehicles by region and evaluate Lotus's competitiveness by technology and sales ability. To justify the 90% growth rate assumption, either of the two unrealistic assumptions should be satisfied. First, the annual growth rates of the market size of luxury electric vehicles are greater than 50% in US and EU and more than 100% in China. Second, The technology of Lotus grows hugely in the following five years, thus giving Lotus a significant competitive edge over its competitors and leading to immense growth in Lotus's market share.

6. Risks

6.1 Exchange Rate Risk

The China and EU luxury electric vehicle market size is converted from RMB to USD using the exchange rate of 1RMB=0.14 USD. If FED keeps going on the interest rate hike, in that case, the exchange rate fluctuation will affect the calculated luxury electric vehicle market size in different regions and thus influence the projected revenue of Lotus.

6.2 China Luxury Electric Vehicle Market Size is overestimated

The market size calculation assumes that more luxury electric vehicle models with higher prices will be on sale in China regarding the enclosed plan of several luxury vehicle brands like Audi in the coming years. If the sale of new models in the coming years meets obstacles such as insufficient capacity, the average price and sale volume of luxury electric vehicles will be lower than the estimation, resulting in a market size more melancholy than the prediction.

Another risk that may arise is China's acceptance of luxury EVs. Although figures estimate that the CAGR of luxury EV sales is expected to rise to 35.1% from 2023 to 2025, current sales may speak a different story. A study on luxury vehicle consumption has shown that brand recognition and perception are the main driving forces of expensive vehicle purchases. However, even renowned brands such as Mercedes Benz have problems with EV sales. The Mercedes EQS Sedan's poor performance of 8,000 units sold may be attributed to the Chinese market not accepting the concept of luxury EVs entirely. With Lotus' brand not fully built in the Chinese market, this effect may have an even more significant impact on the sales of Lotus' Type 133 model, a luxury sedan set to release in 2024, as Lotus.

6.3 Market Share of Lotus is overestimated

The competition in luxury electric vehicles is not fierce as it is still an emerging market. However, as more and more manufacturers enter the market, the competitive power of Lotus will likely be challenged. Though Lotus has a comparative advantage in technology, it needs a more decisive advantage to help it beat the newcomers in the market. Also, its dealerships and the number of direct sale stores don't grant an outstanding benefit for more sales volume. And thus, the market share of Lotus may be lower than predicted due to the possible competition in the market.

6.4 Logistical Risk

All the forecasts made by Lotus are under the assumption that Lotus Tech will complete its global commercial platform according to its master distribution agreement with Lotus UK. Without this agreement, the company will be limited by different national systems, hindering its sales in Europe and America. Since Lotus tech runs on an asset-light model, thus not manufacturing any of the goods, this agreement is instrumental for Lotus Tech to maintain its business model.

6.5 Fund Acquisition Risk

Without a 788-million-dollar fund by the end of 2024 from the LCAA trust and other fundraising methods, the risk of the company's operation and research capabilities will be severely handicapped. The fund is instrumental for the company to deliver its models after 2023, which will make up the bulk of the sales in the future as forecasted.